Business

Call us Now!

Wellington Advisors

A Leading International Corporate Services Provider

assisting and guiding financial, institutional, corporate

and private clients around the world!

We understand our clients’ needs

whether you are looking to start your own brokerage or

you are an established brokerage looking for additional solutions!

Financial Services Provider Registration

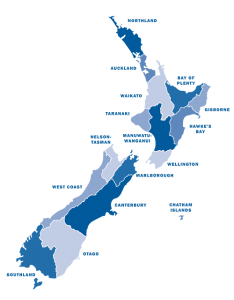

Why be licensed in NZ?

7 Most Relevant

New Zealand Advantages

-

New Zealand is recognized as a premium jurisdiction

-

There is No Minimum Capital Requirement

-

It provides all advantages of all traditional financial centres and is recognized as a true onshore financial centre which is not blacklisted by any jurisdiction or authority in the world.

-

It is not perceived by O.E.C.D. as a harmful tax jurisdiction and has no connotations as a tax haven.

-

It is a member of the O.E.C.D. and World Trade Organization.

-

New Zealand is a member of the British Commonwealth, English is the main language, has a common law system, and the majority of legislation including trust law is founded on British law.

-

It is not a member of the EU and is not influenced by the EU Savings Tax Directive and any future developments.

Meaning of

Financial Services

Some examples of common financial services are below:

Providing financial advice

(including investment planning)

Issuing and managing means of payment (for example, credit and debit cards, cheques, travellers’ cheques, money orders, bankers’ drafts, and electronic money)

Money transfers

Foreign currency exchanges – whether buying or selling

FSP

Permitted Services

Once registered, the FSP can offer:

Financial adviser service

Broking service

Keeping, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons

Operating a money or value transfer service

Issuing and managing means of payment (for example, credit and debit cards, cheques, … amongst others.

Who needs

To be Registered?

Entities and individuals who:

– live or have a place of business in New Zealand; and

– are in the business of providing financial services (in New Zealand or overseas) must register to provide that particular financial service on the FSPR.

Those entities and individuals will have to register as a financial service provider (FSP).

Licensed Market Services

Financial Services requiring FMA License

If you intend to provide financial services under the FMC Act and, if you are registered, or in the process of getting registered as a financial service provider (FSP), you must apply to the Financial Markets Authority (FMA) for a license to provide services under the Financial Markets Conduct Act 2013 (FMC Act).

Market services you need to be licensed for

FSP Registration

Requirements to obtain and

maintain a New Zealand FSP

have recently suffered substantial changes

Concrete proof that the applicant:

- Has the necessary and required professional experience in the financial area, they will be applying for;

- Has the related professional qualification;

- Has set up an office with local qualified employee(s);

- Considers NZ based clients as the major target market to develop;

- Has its website fully compliant with the financial activities it has been granted for;

Your FSP application and FMA

What you need to take into consideration

When applying for FSP registration

New FMA Role

The Financial Markets Authority (FMA) is the New Zealand government agency responsible for financial regulation. It is responsible for regulating all financial market participants, exchanges and the setting and enforcing of financial regulations.

FMA does not oversee or maintain the FSPR, the Companies Office performs this role. But FMA does have the power to deregister a business or individual or prevent them from registering in the first place.

FMA expects that a current or prospective FSP must show clearly how they are conducting the business from NZ, in order to justify having a New Zealand FSP registration.

New Zealand

Cryptocurrency Services

Licensing

If you provide a ‘financial service’ related to crypto currencies, you need to comply with the ‘fair dealing’ requirements in the Financial Markets Conduct Act 2013 (FMC Act). The Financial Service Providers (Registration and Dispute Resolution) Act 2008 and anti-money laundering obligations may also apply. Key activities considered ‘financial services’ include exchanges, wallets, deposits, broking and ICOs.

Exchanges

Wallets

Broking

ICOs and financial services

Fair dealing, registration and other obligations

Due to the nature of cryptocurrency-related financial services

We suggest you approach us about the services you plan to offer.

We are happy to discuss requirements with you and

Your legal advisers on an individual basis

Get your Application a Successful one!

For a license to be granted,

There must be no doubt

That the applicant meets or can meet

All of the licensing requirements

It is our suggestion for a client to visit NZ and

Meet us personally, as soon as

Your NZ corporate entity has been registered

- – Understand the business climate in NZ and our approach to new business ventures, which are always positive, provided the client has a proposition, which is of benefit to NZ as well, and not merely to trade off on our good national reputation;

- – Meet his banking representative to open a full NZ bank account;

- – Meet your local NZ Manager, either directly recruited by you or by Wellington Advisors, should you wish our help and support;

- – Have a look at the prospective part time office set up at Servcorp or elsewhere service we shall be very pleased to provide you and assist you with.

Information we need from you!

– Company Application Form to be filled and signed;

– Organizational/structure chart showing board of directors, shareholders, list of senior persons compliance officer, Money Laundering Reporting Officer, and deputy) and other officers who will be responsible for the day-to-day operations;

– Business plan with 3-year projections giving details of proposed activities, types of customers, products and services to be offered.

– Internal Procedures Manual;

– Anti-Money Laundering & Compliance Procedures Manual;

– Details of proposed membership with an Exchange, clearing and settlement facility, etc;

– Details of procedures and systems to prevent conflicts of interest, terrorism and money laundering;

– An indication as from where the company intends to operate.

Expected Time to Complete

Your FSP Application

Step 1 – The current process appears to take about I ½ to 2 weeks to incorporate a company, obtain a NZ Bank account and necessary/eventual changes on the shareholder and directorship structure.

Step 2 – A Business Plan has to be written and edited, CVs to be vetted, a NZ office and a part time manager appointed before formally applying online with FSPR. Dependent upon WA’s input, it can take another 4 to 6 weeks for this process to be completed.

Step 3 – FSPR tends to take another 4 to 5 weeks, considering all questions they may and usually place before handing over the application to FMA.

Step 4 – FMA’s official position is that their enquiries will take up to 60 working days (i.e., 12 weeks) before we get a definite answer.

Total Expected Timing

To get this whole process completed 25 weeks.

Therefore 5 to 6 months

For you to consider getting your own project licensed,

Will be a reasonable timing!

For those wishing

to reduce expected timing

to get your company FSPR registered

Deciding for a ready-made company

Will be an excellent option!

We have shelf aged companies, registered since 2014

With no Liability or Responsibility

All in good standing and

Ready to promptly start FSPR application!

Wellington Advisors is dedicated to providing

The most professional services.

We endeavour to facilitate

Your application beside our Regulators

Within the shortest time frames available

Should you have any question or

Matter you would like to discuss with us

Contact Us Now!

Wellington Head Offices

44 Mairangi Road, Wadestown

Wellington 6012, NZ

Customer Services

Phone: + 64 4 830 3351

Email: enquiries@fspfinancial.co.nz

Business Development Team

Phone: + 64 4 888 1324

Email: info.wellington@fspfinancial.co.nz

Legal Disclaimer

Wellington & Advisors does not offer legal or tax advice without consultation with certified professionals with related appropriate skill and expertise.

All information contained in this website is for general guidance on matters of interest only and should not be considered as guidance for financial or tax decisions, or a substitute for specific professional consultation, especially if it concerns international tax planning and financial structuring as these areas are subject to frequent changes.

While we have made every effort to ensure that the information contained in this website is accurate and correct due to constant changes in laws, rules and regulations Wellington & Advisors accepts no liability for any loss or damage arising directly or indirectly from action taken or not taken relying on the information contained in this website. In particular no warranty is given as to the completeness, accuracy, reliability of such information and as to whether it is at all times up to date.

Wellington & Advisors Ltd accepts no liability for any loss or damage direct or indirectly arising from the application of any information contained in this website, including any loss, damage or expenses arising from, but not limited to, any defect, error, mistake, inaccuracy, reliability of this website, its contents or related services, or due to any unavailability of this Site or any part thereof of any contents or related services.

Wellington Advisors’ services are subject to its Terms and Conditions.

Registered with I.C.O. – Information Commissioner’s Office, under the Data Protection (Charges and Information) Regulations 2018 (the Regulations)

TBA & Associates – Tax Business Advisors Limited

Registered in England | Company Reg. No. 07074712 | Registered office at SVS House, Oliver Grove, SE25 6EJ London | VAT Registration Nr: 114329148

Registered as Trust and Corporate Service Provider | Supervised by HMRC Anti-Money Laundering Supervision | Registration number: XWML00000128543